Trade Ideas & Chart Analysis Disclaimer: The below analysis should not be considered as considered financial advice or a recommendation to trade or invest in any financial product. Your individual circumstances and risk allowance have not been taken into consideration and are thus not reflected in the below analysis. The below is for educational purposes only. Read our full Risk warning and disclaimer here.

All scenarios are based on 'IF/THEN' scenarios that the Bindal FX traders map out and use whether it be on swing trades shown below, or intraday trades used in the Bindal FX LIVE room every day. If the price does not map out to the plan, we simply move on and look for a new opportunity rather than trying to 'manufacture' a position - to learn more about how to join our LIVE Trading Broadcasts and LIVE Trading Webinars email support@bindalfx.com

Broker - The Bindal FX team primarily trade with the same broker - they are highly reputable and have excellent competitive spreads with lightning-fast execution. Having a good broker with tight spreads is crucial to successful trading. To find out if they are more competitive than your current broker, or to open a live or demo account, you can learn more about them here.

Key Support: 1830

Key Resistance: 1750/60, 1690

GOLD - Last week's Trade If/Then scenario fired beautifully on Gold and turned into a really nice move. For the coming week, our position hasn't changed and as long as we remain below 1830, in the short term we are bearish. 1830 is a really key pivot level, and on a pull back to here, as long as this level holds we will be looking to continue on the short side (primary scenario). If 1830 cannot hold price below, and we move back above, then this will have been the 3rd failed attempt to break and hold below in the last few weeks, which would indicate a real reluctance to move lower. If this 'fake out' occurs and we break back above the Bindal Green Pivot, then we will look to go long on any pullback thereafter.

Short Term Trend: Range

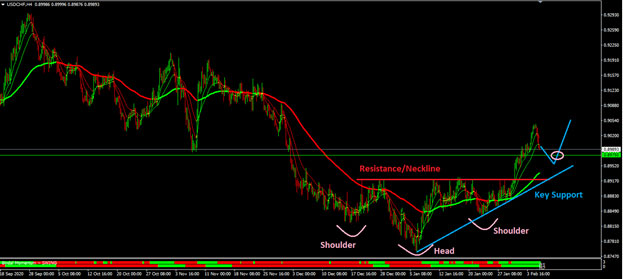

Key Support: 0.8920

Key Resistance: 0.8920

USDCHF - overall this has been in a firm down trend for quite some time, but has spent the last 2 months consolidating nicely. Last week's Trade If/Then scenario painted the picture in the chart you see below (4-hour chart) that we have a confluence of setups that could trigger, with an ascending triangle and inverse H&S pattern. If you are a break out trader, or trading lower time frames this will have given some very nice long opportunities from this alert. A pullback is now happening on the 4 hour chart, and as long as price holds above 0.8920, we will be looking to take longs somewhere near the key support/neckline and the green pivot. If price backs below 0.8920, then we would consider this quite bearish and would look for a continuation of the longer-term trend.

Key Support: 35,900

Key Resistance: 38,600; 40,200; 42,000

BITCOIN - Last week's Trade If/Then scenario fired beautifully on Bitcoin giving us a really nice run up, a move of around $4000, or a 12% gain which is a fantastic return. Nothing has changed for us the chart is still bullish for us at this moment in time. There are 2 potential long scenarios in play right now as show by the Chart below. We will be patient with this and wait for a really nice obvious entry to add in. We have no preference over either scenario, but as long as we remain above the Bindal FX Green Pivot, then we will be looking at only the long side on either one of these scenarios. Shorts only come into play on a decisive break below $35,900.

Free E-book and newsletter sign up - www.bindalfx.com/ebook.php

Sign up for our free e-book and automatically receive our Weekly Trade Idea's Newsletter

Follow us on social media for more trading insights and free education material